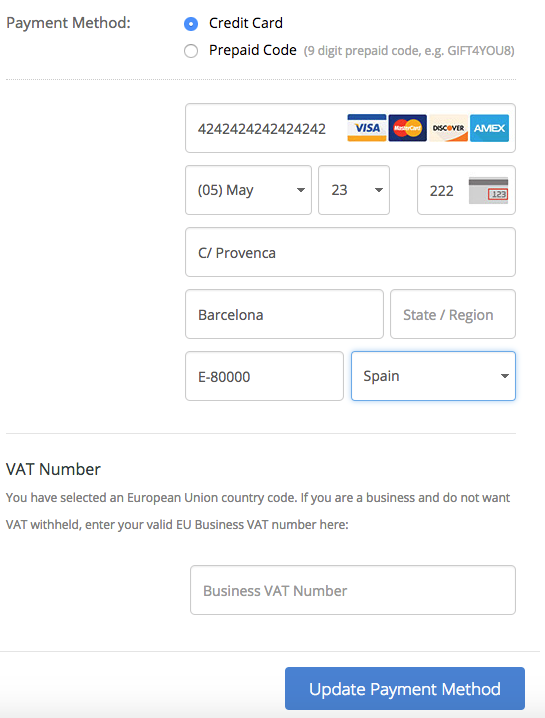

VAT is based on location, you can set up the VAT information when you add your billing information, then select your country, the VAT field will appear if it is applicable:

If your billing is already set up, then you will need to sign in to your account here:

https://secure.backblaze.com/user_signin.htm

Type in your account email and password for Backblaze then click the sign in button.

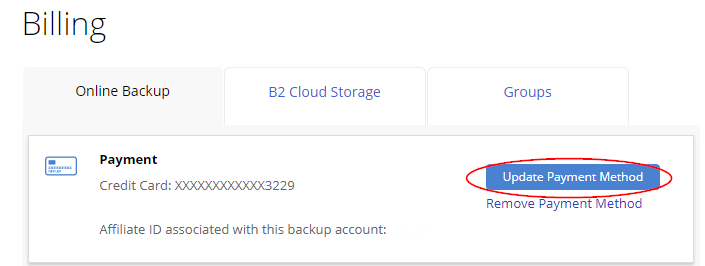

Click the Billing link in the left-hand navigation panel.

Then click update payment method.

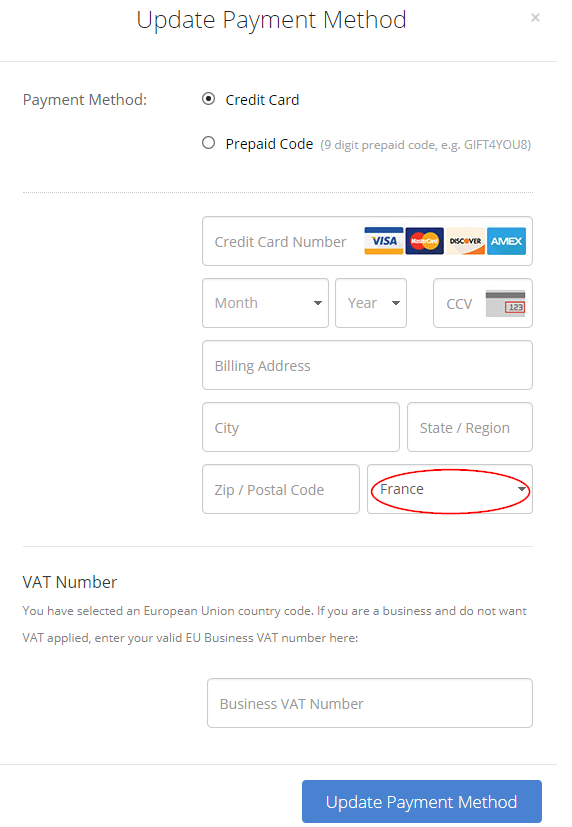

When you choose the country it will prompt for the VAT number:

Enter your country code and your VAT number to attach the VAT number to your account.

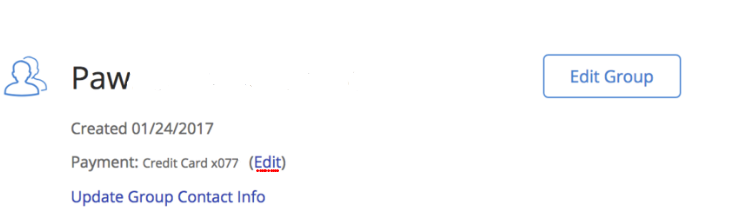

If you are creating a group, once you create the group and go to step 2, you will be asked for the VAT number, and if you have a group set up, then you can click on the Edit link in the group next to payment section, then add the VAT number here.

For more information on VAT formats please go here.

If you would like to know the rate for your EU country please see here:

Backblaze's VAT ID is EU372006241, and our registered member state is Ireland.

Related

For information on US-based tax collection please see this link:

Tax Collection and Fees for the US

Articles in this section

- Disabling The "Locate My Computer" Feature

- Backblaze Maintenance Schedule

- U.S. East Data Region FAQ

- How to find your userPub.pem file on Windows

- Why is my hard drive listed twice?

- Why am I receiving a pop-up about a missing or duplicate .bzvol?

- Where are iCloud files located in my backup? (Mac)

- Migrate data from old computer to new computer with Backblaze

- Why does Backblaze need my private encryption key to restore?

- Version History: Stopping, or resetting progressive billing on the Forever setting.